History

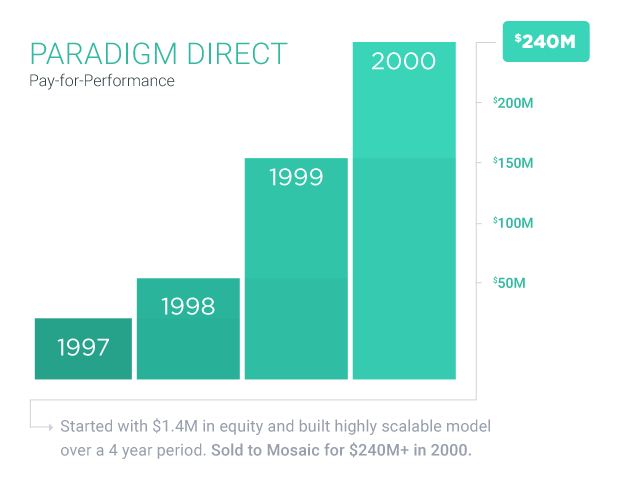

In February 1997, Marc Byron, the CEO of Trivergance, started Paradigm Direct, an innovative and highly disruptive company in the marketing services sector, raising just $1.4 million in seed capital. Jerry Stone, a partner and the COO of Trivergance joined shortly thereafter, as Paradigm Direct introduced a pioneering business model of that time, which later was termed "performance marketing." Unlike competitors, who were paid based on time and materials for the marketing services they provided, Paradigm Direct's remuneration was tied to the full delivery and provisioning of a customer. The company changed the landscape of marketing services going forward, opening the door for an entire performance marketing industry to bloom and flourish.

The company changed the landscape of marketing services

After successfully designing and executing performance marketing programs for clients such as AT&T Wireless, Cingular, Qwest, Prudential, Progressive, Metris, E*Trade, and DirecTV, Paradigm Direct was sold for approximately $240 million, approximately 36 months after its inception.

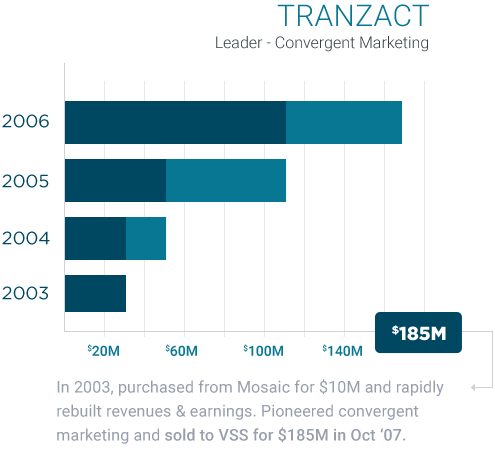

In 2003, the parent company that bought Paradigm in 2000 experienced financial stress, and management had the opportunity to buy back the company. As a result, Marc Byron and his partners bought the company back for approximately $10 million, in partnership with Halyard Capital, and renamed it Tranzact. The team systematically rebuilt the business utilizing its business model of developing innovative, measurable and cost-managed customer acquisition solutions, and delivered large numbers of new, incremental customers to client brands. Approximately four years after the buy back, Tranzact was sold for $185 million, or 18.5x the original investment, to another New York based, private equity firm, Veronis Suhler Stevenson.

Innovative, measurable & cost-managed customer acquisition solutions

Building on their successful team efforts and consistent track record, in 2006 the partners formed Trivergance. The specific thesis behind Trivergance was to create a platform of being an independent (unfunded) sponsor model, combined with a deep, rich, full-time staff of functional experts across our business building and customer acquisition expertise. Trivergance was three things coming together – Human Capital, Financial Capital and Intellectual Capital. This unique combination enabled Trivergance to both invest third-party capital, as their fiduciary, and provide operational and significant “growth effort” support to existing management teams of our portfolio companies. The intended and actual results have been consistently excellent - with performance and returns on deployed capital being in the top-quartile.